It’s not just about money.

It’s about building your future.

There’s a serious lack of personal finance education that’s robbing many Americans of the retirement and future they deserve. The saying “what you don’t know can cost you” exists for a reason!

Here’s a figure for you:

The U.S. Department of Labor has stated that fewer than half of all Americans have calculated how much money they’ll need in retirement.*

This statement would not be true if more people just like you enlisted the help of a holistic Financial Planner to help piece together their unique financial puzzle.

The right Financial Planner is truly a guide and partner that can help you throughout your life!

The problem is that my industry’s gotten a bad rep (and rightfully so), and caused a ton of confusion out there for average people who just want to find someone out there they can trust.

There are many ‘Financial Advisors’ using that title, when in fact less than 6% of Financial Planners are fee-only, fiduciary Financial Planners - and it’s estimated that non-fiduciary advice costs investors up to $17 billion* every year!

I want that to change. That’s why I made it my goal to teach you what you need to be aware of when you’re searching for a Financial Planner.

*Source: http://www.dol.gov

Hi, I’m Dana.

I help people just like you confidently make smart financial decisions that increase their quality of life today and into the future.

I got my start as a Financial Planner in 2001 (right after 9/11 changed the world), and founded Twin Cities Wealth Strategies, Inc. in 2016.

As a fiduciary Financial Planner, I give advice that allows my clients to live the lives they were meant to live and not the life society tells them they should.

With over 20 years of experience under my belt, I help my clients concentrate on what they can control, such as their goals, values, lifestyle choices, investment fees, and the amount of taxes they will ultimately pay.

What if I could show you exactly what you need to be aware of when you’re looking for a Financial Planner?

Armed with that knowledge, you can be confident that you’re making the best decision for bringing in the right pro to help you safeguard your financial future.

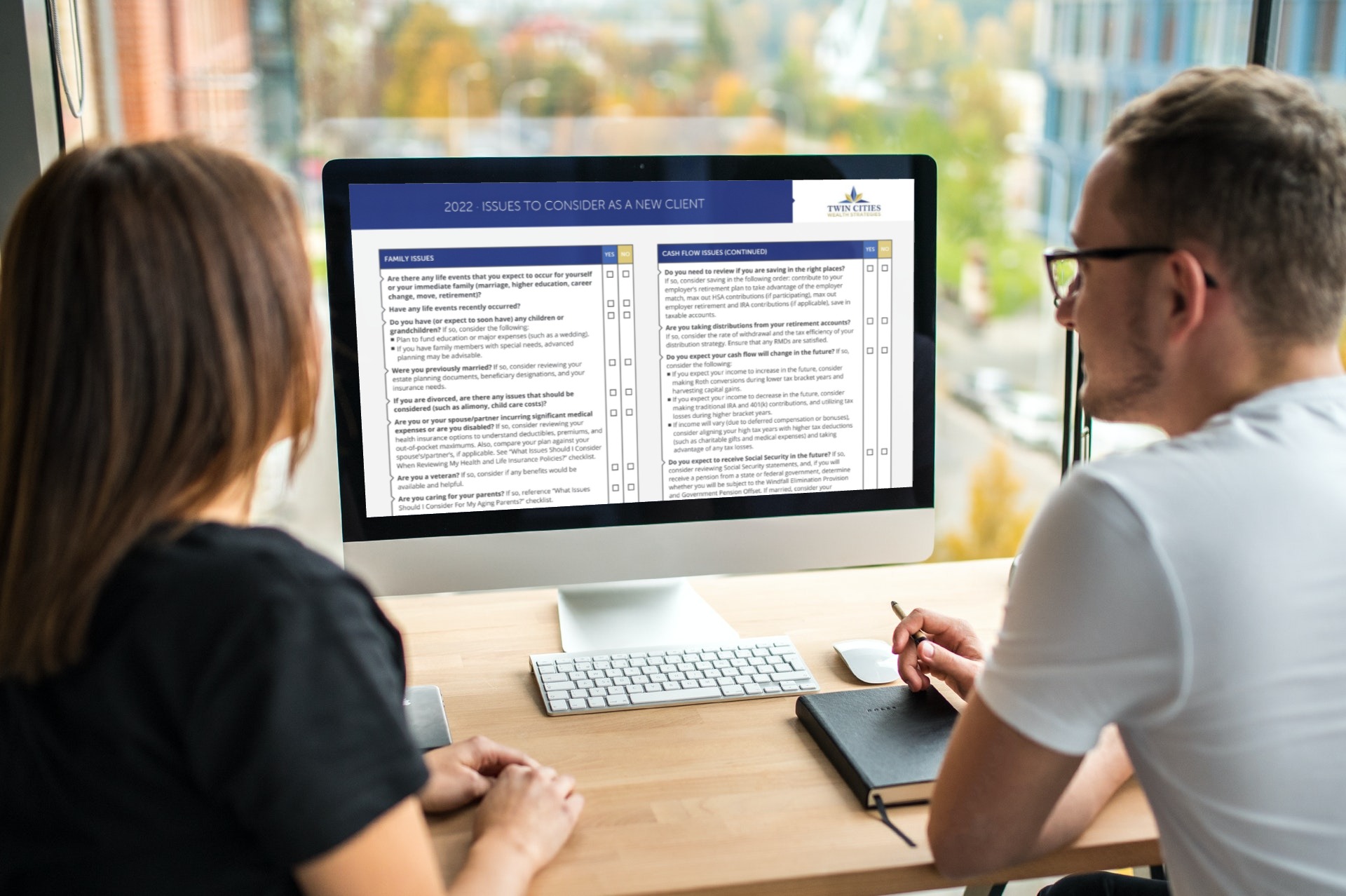

That’s exactly why I created the “Issues To Consider As A New Client” checklist.

When you sign up below, you will get an easy-to-follow 2-page checklist detailing what you should know when you look to hire a Financial Planner!

After going through the checklist, you'll have a much better understanding of some of the main financial issues you can expect a good Financial Planner to examine.

It's exactly what I review and optimize with my very own clients to prepare them for retirement and beyond!

But it doesn’t stop there.

Enter your details below now and you won’t just get the “Issues to Consider As A New Client” checklist. Right away, you’ll get the checklist and the following bonuses in your inbox:

A free copy of my e-book “What Is Fiduciary Investment Advice, And Why Does It Matter?” (the perfect add-on to the checklist - I’ll go even more in-depth on what you need to know about finding a fiduciary Financial Planner and why it matters.)

Access to my email newsletter where you get my insider tips on personal finance and current events.

You also get first dibs on seats to my online monthly web classes! I promise that it’s unlike any other financial newsletter you’ll ever sign up for.

Here’s what others had to say:

"I've been getting your emails for the past year now and I really enjoy reading them. They are full of great advice and are entertaining as well."

- Ken F.

"Your email came at just the right time. Dave and I have been discussing getting our estate plan updated and your message made us realize how important it is. Thanks again!"

- Sarah L.

"I never thought I would enjoy reading a financial advisor's email, but you proved me wrong. Keep 'em coming!"

- Laura M.

Don’t miss out on all the benefits of finding the right Financial Planner.

Grab the checklist today!

Call us at: (763) 445-2772

Email us at: [email protected]

Address: 11670 Fountains Drive Suite 200

Maple Grove, MN 55369